![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Financial Statement And Dividend Announcement For The First Half Ended 30 June 2025 (“1H25”)

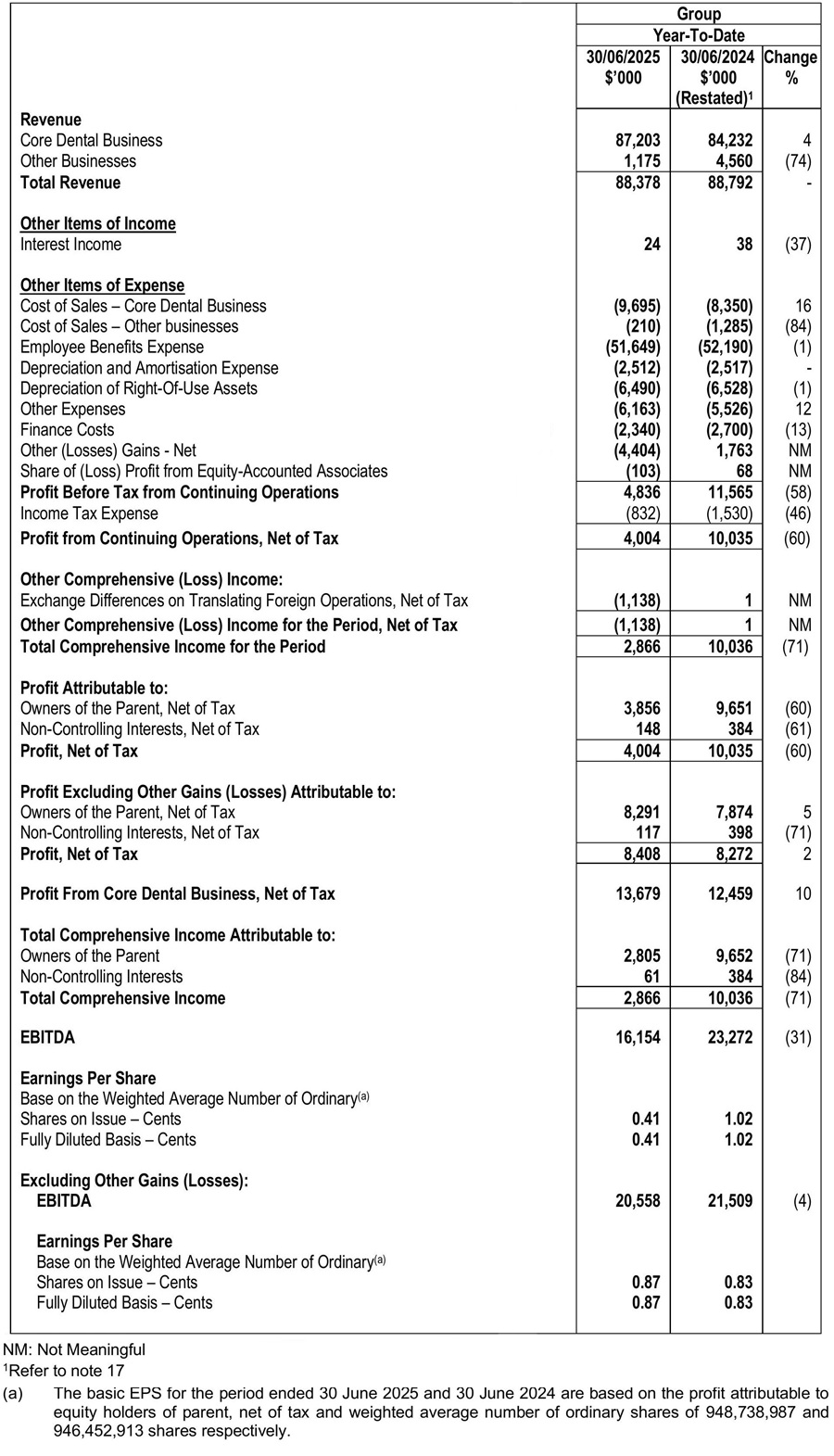

Condensed Interim Consolidated Statement of Profit or Loss and Other Comprehensive Income

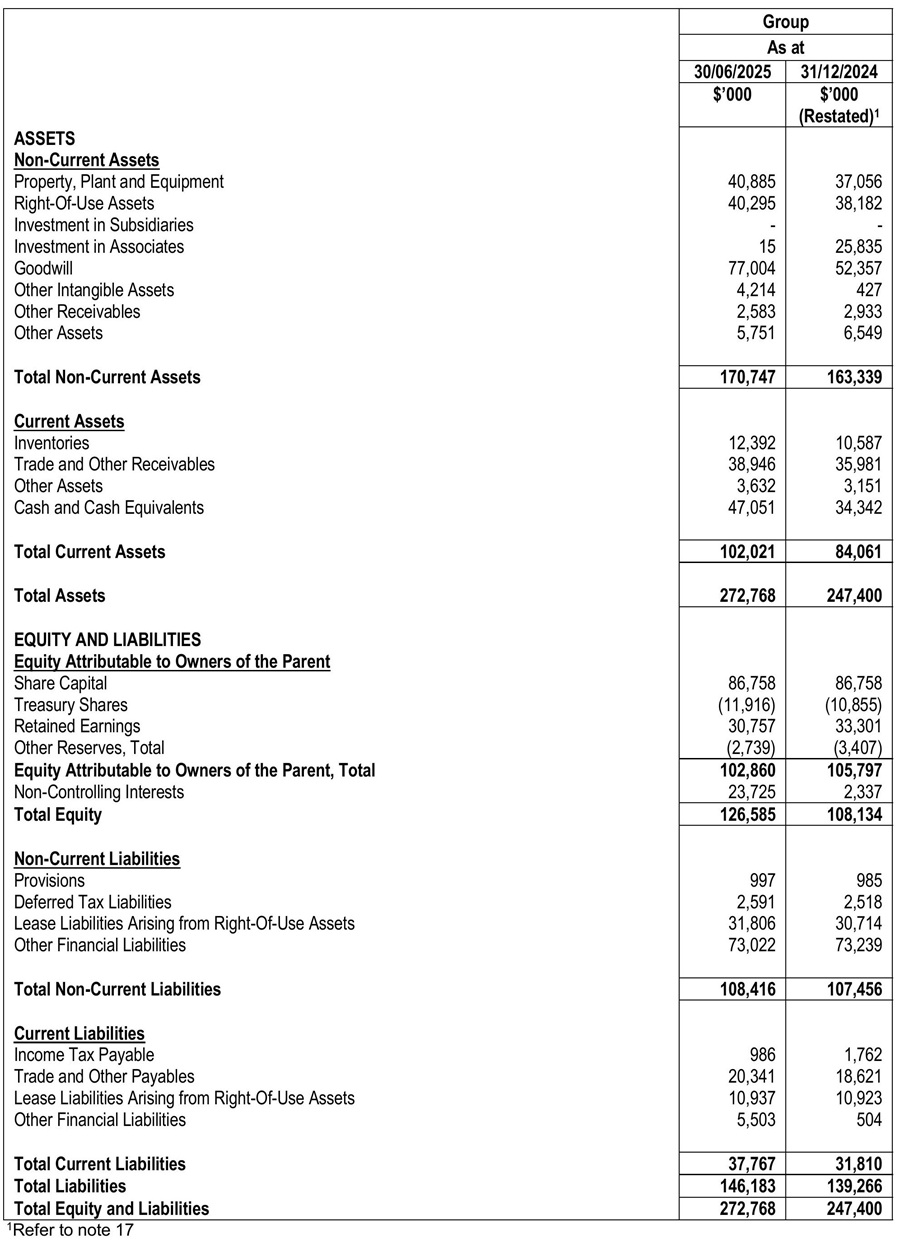

Condensed Interim Statements of Financial Position

Review of Performance

Statement of Comprehensive Income

Revenue

In Singapore, the Group has 108 dental outlets, 5 medical outlets, 1 dental college and 1 dental equipment & supplies distribution company as at 30 June 2025 compared to 104 dental outlets, 5 medical outlets, 1 dental college, 1 dental equipment & supplies distribution company and 1 medical laboratory company as at 30 June 2024.

In Malaysia, the Group has 37 dental outlets and 1 dental equipment & supplies distribution company as at 30 June 2025 compared to 44 dental outlets and 1 dental equipment & supplies distribution company as at 30 June 2024.

In China, the Group has 7 dental polyclinics, 7 dental hospital, 5 dental training centres, 2 dental distribution & supplies company and 3 dental laboratories as at 30 June 2025.

The revenue contribution from core dental business increased by 4% from $84.2 million for the first six months ended 30 June 2024 (“1H24”) to $87.2 million for the first six months ended 30 June 2025 (“1H25”). The increase of $3.0 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25, higher revenue contribution from the Group’s equipment & supplies distribution companies in Singapore and Malaysia offset by marginally lower revenue contribution from Singapore dental clinics.

The revenue contribution from the other businesses decreased by 74% from $4.6 million in 1H24 to $1.2 million in 1H25. The decrease of $3.4 million was mainly due to the cessation of the Group’s medical laboratory in September 2024 due to the expiry of the clinical laboratory service licence.

Other (Losses) Gains – Net

Net other losses of $4.4 million in 1H25 was mainly due to the loss arising from the deemed disposal of Aoxin Q & M and EM2AI when the Group gained control of these entities and reclassified them from equity-accounted associates to subsidiaries of the Group in 1H25.

Net other gains of $1.8 million in 1H24 was mainly due to gain on disposal of EM2AI as well as compensation from ex-vendors for the settlement and termination deed for Shanghai Chuangyi Investment & Management Co., Ltd. and ex-vendors from AR Dental Supplies Sdn. Bhd..

Other Items of Expense

Cost of Sales from Core Dental Business

Cost of sales from core dental business increased by 16% from $8.4 million in 1H24 to $9.7 million in 1H25. The increase of $1.3 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25.

As a percentage of revenue from the core dental business, cost of sales used in the core dental business in 1H25 was 11.1% compared to 9.9% in 1H24.

Cost of Sales from Other Businesses

The cost of sales from other businesses decreased by 84% from $1.3 million in 1H24 to $0.2 million in 1H25. The decrease of $1.1 million was mainly due to the cessation of the Group’s medical laboratory in September 2024 due to the expiry of the clinical laboratory service licence.

As a percentage of revenue from other businesses, cost of sales used in other businesses in 1H25 was 17.9% compared to 28.2% in 1H24.

Other Expenses

Other expenses increased by 12% from $5.5 million in 1H24 to $6.2 million in 1H25. The increase of $0.7 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25, as well as increase in credit card commission charges, insurance expense and legal and professional fees for the Group’s Singapore operation.

As a percentage of revenue, other expenses in 1H25 was 7.0% compared to 6.2% in 1H24.

Finance Costs

Finance costs decreased by 13% from $2.7 million in 1H24 to $2.3 million in 1H25. The decrease of $0.4 million was due to lower interest expense in 1H25.

As a percentage of revenue, finance costs in 1H25 was 2.6% compared to 3.0% in 1H24.

Share of (Loss) Profit from Equity-Accounted Associates

The Group recorded a share of loss from equity-accounted associates of $0.1 million in 1H25 due to a share of loss from equity-accounted associate, EM2AI, offset by a share of profit from equity-accounted associate, Aoxin Q & M. EM2AI and Aoxin Q & M are now subsidiaries of the Group.

The Group recorded a share of profit from equity-accounted associates of $0.1 million in 1H24 mainly due to a share of profit contributed by the equity-accounted associate, Aoxin Q & M.

Profit Before Tax and Net Profit After Tax

The Group’s profit before tax decreased from $11.6 million in 1H24 to $4.8 million in 1H25. The Group’s net profit after tax decreased from $10.0 million in 1H24 to $4.0 million in 1H25.

Excluding the impact of other gains and losses, the Group’s net profit after tax without the other gains and losses increased from $8.3 million in 1H24 to $8.4 million in 1H25.

Profit attributable to owners of the parent decreased from $9.7 million in 1H24 to $3.9million in 1H25. Excluding the impact of other gains and losses, profit attributable to owners of the parent increased from $7.9 million in 1H24 to $$8.3 million in 1H25.

Statement of Financial Position

As at 30 June 2025, the Group has cash and cash equivalents of $47.1 million while bank borrowings plus finance leases amounted to $78.5 million. As at 31 December 2024, the Group has cash and cash equivalents of $34.3 million while bank borrowings plus finance leases amounted to $73.7 million.

Current Assets

Inventory as at 30 June 2025 increased to $12.4 million from $10.6 million as at 31 December 2024. The increase of $1.8 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25 offset by decrease in inventory from the dental equipment & supplies distribution company in Malaysia.

Trade and other receivables as at 30 June 2025 increased to $38.9 million from $36.0 million as at 31 December 2024. The increase of $2.9 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25 offset by loan due from EM2AI now recognised as a subsidiary receivables following the consolidation of EM2AI from an equity-accounted associate to a subsidiary in 1H25 as well as decrease in profit guarantee receivable.

Other assets as at 30 June 2025 increased to $3.6 million from $3.2 million as at 31 December 2024. The increase of $0.4 was mainly due to increase in prepayment arising from the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25.

Non-Current Assets

The net book value of property, plant and equipment as at 30 June 2025 increased to $40.9 million from $37.1 million as at 31 December 2024. The increase of $3.8 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25 offset by depreciation for plant and equipment.

The net book value of ROU asset as at 30 June 2025 increased to $40.3 million from $38.2 million as at 31 December 2024. The increase of $2.1 million was due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25 and opening of new clinics offset by depreciation of the ROU assets.

Investment in associates as at 30 June 2025 decreased to $15k from $25.8 million as at 31 December 2024. The decrease of $25.8 million due to the consolidation of Aoxin Q & M and EM2AI from equity-accounted associates to subsidiaries of the Group in 1H25.

Goodwill as at 30 June 2025 increased to $77.0 million from $52.4 million as at 31 December 2024. The increase of $24.6 million was mainly due to the consolidation of Aoxin Q & M and EM2AI from equity-accounted associates to subsidiaries of the Group in 1H25.

Other intangible assets as at 30 June 2025 increased to $4.2 million from $$0.4 million as at 31 December 2024. The increase of $3.8 million was mainly due to the consolidation of Aoxin Q & M and EM2AI from equity-accounted associates to subsidiaries of the Group in 1H25 offset by amortisation of other intangible assets in 1H25.

Other receivables as at 30 June 2025 decreased to $2.6 million from $2.9 million in 31 December 2024. The decrease of $0.3 million was due to the repayment of loan by the dentists of the Company.

Other assets as at 30 June 2025 decreased to $5.8 million from $6.5 million as at 31 December 2024. The decrease of $0.7 million was due to amortisation of sign on bonus for dentists.

Current Liabilities

Trade and other payables as at 30 June 2025 increased to $20.3 million from $18.6 million as at 31 December 2024. The increase of $1.7 million was mainly due to the consolidation of Aoxin Q & M and EM2AI from equity-accounted associates to subsidiaries of the Group in 1H25 offset payment of professional fees to dentists, doctors and staff bonuses which were accrued as at 31 December 2024.

Other financial liabilities as at 30 June 2025 increased to $5.5 million from $0.5 million as at 31 December 2024. The increase of $5.0 million was due to draw down of $5.0 million bank loan.

Non-Current Liabilities

Lease liabilities from ROU assets as at 30 June 2025 increased to $31.8 million from $30.7 million as at 31 December 2024. The increase of $1.1 million was mainly due to the consolidation of Aoxin Q & M from an equity-accounted associate to a subsidiary of the Group in 1H25, renewal of operating leases and opening of new clinics offset by repayment of operating lease.

Statement of Cash Flows

The Group generated net cash flow from operating activities of $15.0 million in 1H25. This was mainly derived from the profit generated from operations in 1H25 offset by decrease in trade and other payables and income taxes paid.

Net cash from investing activities in 1H25 amounted to $9.9 million, mainly due to consolidation of Aoxin Q&M and EM2AI from equity-accounted associates to subsidiary of the Group and decrease in sign on bonus for dentists offset by the purchase of plant and equipment for the existing and new dental clinics.

Net cash used in financing activities in 1H25 was $12.2 million, mainly due to repayment of lease liabilities arising from right-of use assets, dividend payment to shareholders offset by proceeds from term loan.

Consequent to the above factors, the Group’s cash and cash equivalents was $47.1 million as at 30 June 2025.

Commentary

Industry Prospects

Barring any unforeseen circumstances, there are no known significant changes in the trends and competitive conditions of the industry in which the Group operates and no other major known factors or events that may adversely affect the Group in the next reporting period and the next 12 months.

Recent Developments and Future Plans

With the Company’s recent successful issuance of $130 million in 3.95% notes that demonstrated strong investor interest, the Management is actively looking for M&A and organic expansion opportunities to allocate the proceeds in a strategic and value-accretive manner.

The Group remains committed to expanding its network of clinics in Singapore, primarily through organic growth alongside strategic acquisitions that are value-accretive to the business. To support this expansion, talent acquisition and retention will be a key focus, ensuring the Group has the necessary human capital to meet the growing demand.

Beyond Singapore, Q & M is actively exploring opportunities to expand its dental business, particularly in the Johor-Singapore Special Economic Zone with the upcoming Rapid Transit System (‘RTS’). The Company is considering various strategies to mitigate the potential outflow of patients to Johor, who may seek to capitalise on the financial advantages of the currency exchange rate once the RTS becomes operational around December 2026.

At the same time, the Company is aware that PRC’s dental market is undergoing a rapid consolidation phase. As a result, Q & M is carefully evaluating opportunities to expand its dental business in China.

Notes

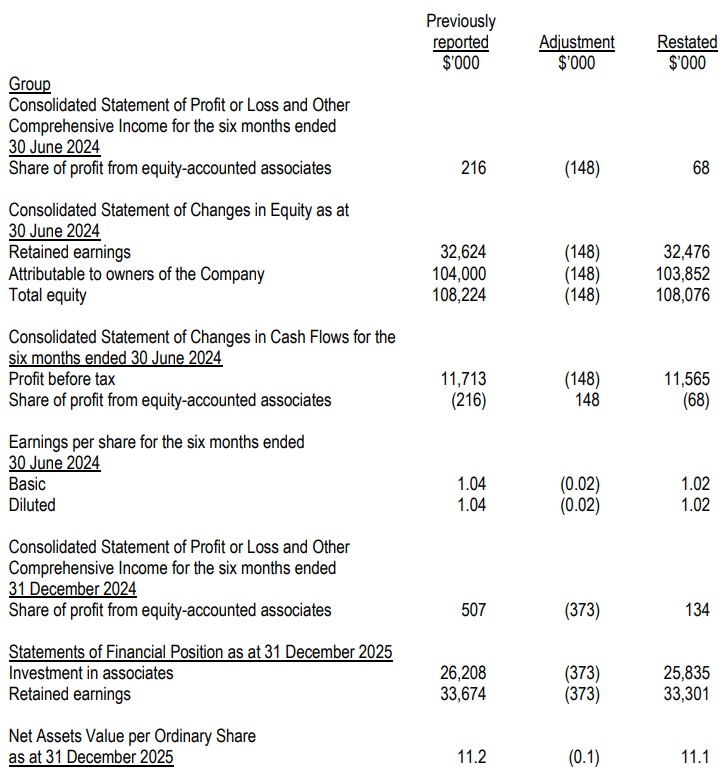

17. Restatement of prior period financial statements

During the six months ended 30 June 2025, upon the request of the National Healthcare Security Administration 国家医疗保障局 (“NHSA”), a Chinese government agency that oversees, inter alia, the nation’s health insurance plan and centralized purchasing of drugs and medical supplies, Aoxin Q & M conducted a self-review exercise on two of the hospitals, namely Shenyang Aoxin Q & M Stomatology Hospital Co., Ltd. and Shenyang City Shenhe District No. 6 Hospital (Shenyang Aoxin Q & M Stomatology Hospital Co., Ltd. – Branch Hospital) (the “Hospitals”). Further to the self-review, NHSA and the Hospitals concluded that there was an excess claim of cost of material from NHSA amounting in aggregate to approximately RMB6.2 million for FY2024. This overclaim resulted in an overstatement of revenue and understatement of liabilities in the twelve months period ended 31 December 2024. The overstatement of revenue and understatement of liabilities have been adjusted retrospectively by Aoxin Q & M. As a result, the Group’s consolidated statement of financial position, consolidated statement of profit or loss and other comprehensive income, consolidated statement of changes of equity, consolidated statement of cash flows and earning per share of the Group for 1H2024, 2H2024 and FY2024 had since been restated.

The following table summarises the impact of the statement on the affected line items if 1H2024, 2H2024 and FY2024 financial statements: